How to sign in to MyUrsuline

In the top right corner click Login.

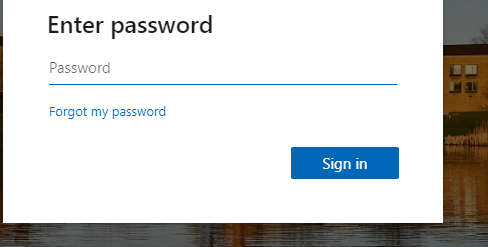

If you are directed to the Microsoft Single Sign On (SSO) page, enter your full Ursuline email address (include @ursuline.edu) and click next.

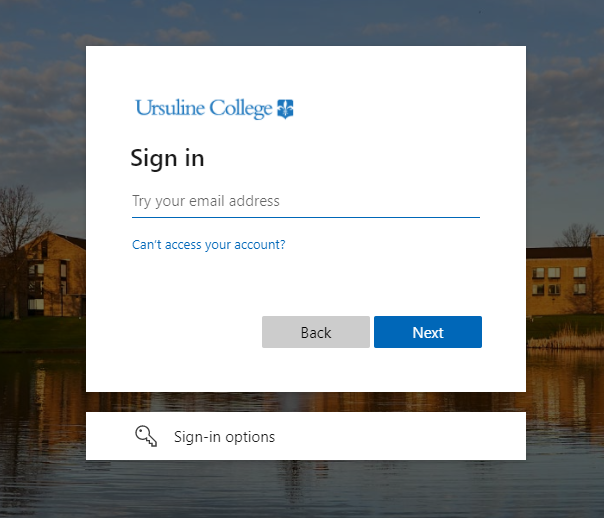

Enter your Ursuline password and click sign in.